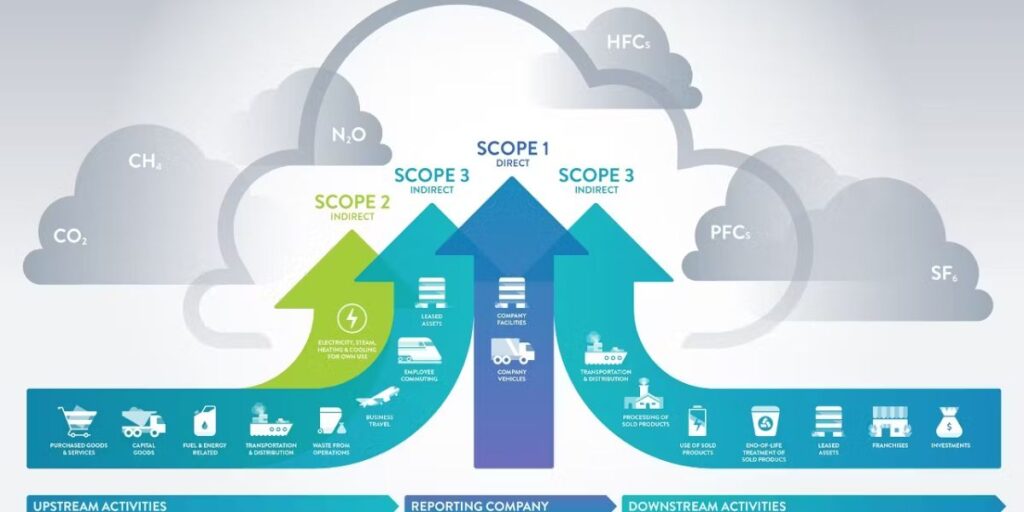

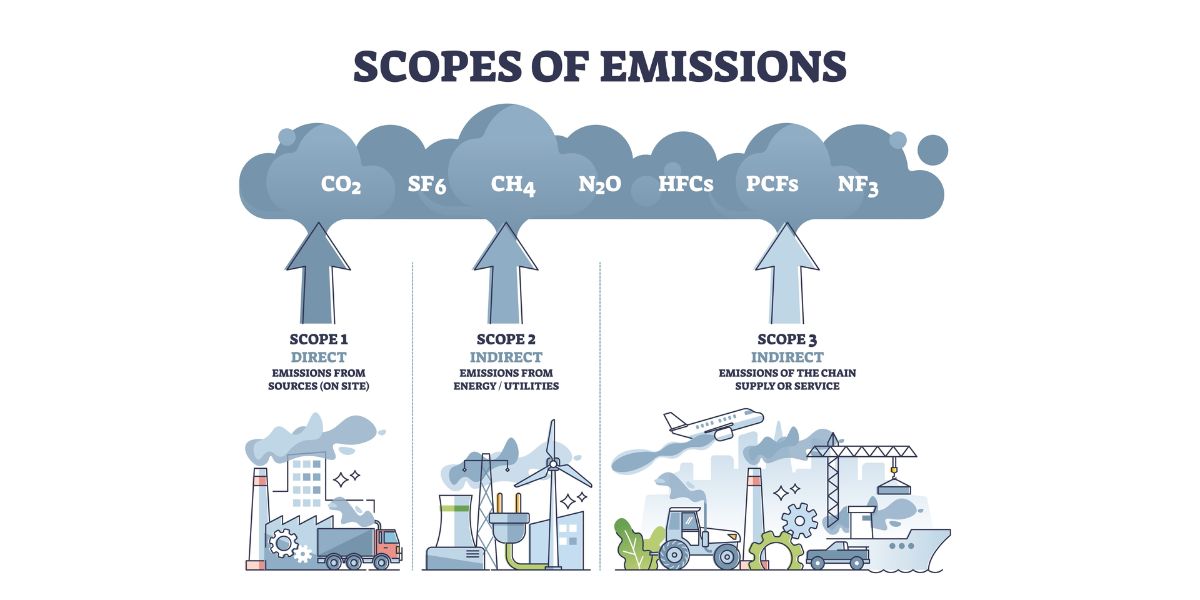

Scope 3 emissions have become the hidden iceberg beneath many companies’ clean-carbon rhetoric. These are the greenhouse gas emissions generated outside a company’s immediate operations, by its suppliers, logistics, customers, and even how people use its products. For many organizations, indirect emissions make up the bulk of their total carbon footprint. Yet, in ESG reporting, they remain the most neglected and misunderstood.

In this post, we’ll dig into why scope 3 emissions reporting is often the biggest blind spot in ESG disclosure, how to measure them, and why companies must face this challenge head-on.

Why Scope 3 Emissions Are a Blind Spot?

The Scale Is Massive

Recent research from Boston Consulting Group (BCG) and CDP found that, on average, companies’ upstream Scope 3 emissions are 26 times greater than their direct emissions. That’s a staggering multiplier, and yet, many companies barely scratch the surface when reporting them.

Low Target Setting, Low Transparency

Despite their outsized importance, Scope 3 emissions continue to be ignored in corporate climate strategies. Only about 15% of corporates surveyed by CDP have set a target for their upstream Scope 3 emissions. That lack of ambition leaves huge climate risk unaddressed and undermines the credibility of ESG commitments.

Big Regulatory and Financial Risks

Investors, regulators, and other stakeholders demand real transparency. A failure to report these emissions can lead to reputational risk, missed regulatory requirements, and an underestimation of long-term financial liabilities. On top of that, ignoring Scope 3 can signal greenwashing, or worse, financial blind spots in supply chain risk.

If you need to cover all your bases and need reliable emissions accounting for financial services with accurate reports, reach out to Spectreco today!

Value Chain Complexity

One key reason Scope 3 stays hidden is the complexity of value chains. Tier-2 and deeper suppliers don’t always share data, and many companies lack visibility into downstream emissions. Traditional spreadsheets and manual surveys often fail to map emissions across every leg of the value chain.

How to Measure Scope 3 Emissions?

Measuring scope 3 emissions reporting is a big undertaking, but with the right approach, it becomes manageable and powerful.

1. Identify Relevant Categories

The GHG Protocol defines 15 Scope 3 categories, covering both upstream and downstream. Your first step is to assess which of these categories actually apply to your business and value chain.

2. Choose Your Calculation Method

There are multiple ways to calculate Scope 3 emissions depending on available data:

- Supplier-specific method: Collect data directly from suppliers, such as product-level emissions or lifecycle assessments.

- Hybrid method: Combine specific data with secondary data for less transparent suppliers.

- Average-data method: Use industry-average emission factors and activity data.

- Spend-based method: Multiply economic spend by emissions factors (EEIO models) for a rough, high-level estimate.

3. Build A Data Collection Strategy

Gathering the data is often the hardest part. PwC recommends:

- Engaging with procurement, finance, and supply chain teams.

- Reaching out to your top-emitting suppliers for detailed data.

- Using secondary data (e.g., industry databases, environmental product declarations) when supplier data is missing.

- Being transparent about data sources, quality, and assumptions.

4. Iterative Improvement

You don’t have to get it perfect on the first try. The U.S. EPA guidance suggests a phased approach: start with the most material categories and methods, then improve accuracy over time by switching to more precise data. As your supply chain matures, you can move from spend-based estimates to supplier-specific or hybrid methods.

5. Verification and Assurance

Third-party verification can build stakeholder trust. Start with limited assurance and progressively work toward a more rigorous audit of your Scope 3 inventory.

Why ESG Disclosure Scope 3 Matters for Your Business?

Investor Confidence and Market Access

Investors are paying more attention to ESG disclosure Scope 3 than ever. Transparent, credible reporting reassures capital providers that you understand your full carbon risk. Without it, you may lose access to green financing or face blowback during M&A conversations.

Regulatory Readiness

Regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) are pushing companies to include Scope 3 emissions in their mandatory disclosures. Getting ahead now means avoiding last-minute scrambles and potential penalties.

Competitive Differentiation

When you measure and manage Scope 3 emissions, you can engage your suppliers proactively, drive emissions reductions, and turn climate risk into a strategic advantage. According to the BCG/CDP report, leaders who engage suppliers and embed internal carbon pricing are more likely to set ambitious upstream targets.

Risk Management

Scope 3 emissions expose real financial risks: regulatory liability, supply chain disruption, and reputational damage. By mapping and reducing these emissions, you mitigate those risks and build resilience.

Practical Tips to Get Started

- Begin by producing a screening assessment to identify which Scope 3 categories matter most for you.

- Use a hybrid calculation method if full supplier data is not yet available.

- Invest in supplier engagement, especially with the largest emitters. Show them how their decarbonization can support shared goals.

- Consider implementing an internal carbon price to guide investment decisions and encourage low-carbon choices.

- Track progress, update your inventory annually, and refine your methodology each year.

The Role of an ESG Strategic Partner

Companies often outsource this complexity to ESG advisory teams. Experts can help set up your Scope 3 emissions reporting system, choose methods, engage suppliers, and even integrate internal carbon pricing.

For infrastructure, built environment, and cross-border operations, a partner like Spectreco can be transformative: offering data-driven solutions, global regulatory expertise, and ready-to-deploy frameworks to bring how to measure Scope 3 emissions into a tangible, actionable reality.

Conclusion

Scope 3 emissions pose the biggest blind spot in ESG reporting, and underestimating them is no small risk. They represent a vast portion of the carbon footprint for many companies, yet are often ignored in sustainability strategy, investor communication, and regulatory planning. Measuring, disclosing, and managing them is hard, but absolutely essential. With deliberate effort and the right partner, you can turn those invisible emissions into a strategic advantage. By getting serious about Scope 3 emissions reporting, you not only reduce your climate risk but also earn deeper investor trust, sharpen your ESG performance, and safeguard long-term value. As a global partner, Spectreco is ready to help you unlock the full potential of your sustainability strategy.

2 comments on "Scope 3 Emissions and ESG Reporting: The Biggest Blind Spot in Corporate Disclosures"

🔞 Dating for sex. Apply ⇾ yandex.com/poll/83KivWDXMPec4g5zdPdmjT?hs=14090d0a0fdaf9bd91935ad043019941& Task Reminder № NPLA7391644 🔞

-iqlabq

😏 Transfer to your wallet. Log In ▸ yandex.com/poll/GjSFvwyKcmEMXpzm6yDExc?hs=14090d0a0fdaf9bd91935ad043019941& 😏

-slewa1