Investment Emissions Reporting

Through Investment Portfolio Emissions Reporting, Spectreco reveals the unseen emissions in your value chain to drive sustainable, profitable investments.

Drive Profitable Climate Action with Emission Reporting for Investors

Investor emissions reporting tracks and discloses greenhouse gas (GHG) emissions linked to a company’s financial investments, classified under Scope 3, Category 15. These emissions arise from the operations of portfolio companies where investors hold stakes.

Often overlooked, they represent significant climate impact and financial risk. Leveraging emission data for investment analysis empowers asset managers and financial institutions to make informed decisions, align with Net Zero goals, ensure compliance, and drive sustainable, profitable growth.

Key Components of Investor Emissions Reporting

Financed Emissions

Financed Emissions

Portfolio Analysis

Portfolio Analysis

Data Attribution

Data Attribution

Methodology Alignment

Methodology Alignment

Risk Assessment

Risk Assessment

Climate Targets

Climate Targets

Regulatory Compliance

Regulatory Compliance

Turn Data into Action

Effective Approaches to Cutting Investment Emissions

Partnering with Investee Companies

- Collaborate for Impact

Work directly with investee companies to develop and implement practical strategies that significantly reduce emissions across their operations.

- Promote Clean Technologies

Encourage portfolio companies to adopt innovative, energy-efficient technologies and sustainable practices that lower their environmental footprint.

- Enhance ESG Transparency

Support investees in gathering accurate ESG data, improving disclosure quality, and stakeholder confidence in their sustainability efforts.

Establishing Science-Based Targets

- Set Clear Reduction Goals

Define measurable, science-aligned greenhouse gas reduction targets across your investment portfolio to drive meaningful climate action.

- Align with Global Standards

Ensure your investment strategies comply with international climate agreements like the Paris Accord to mitigate climate risks.

- Track Consistently

Implement reliable, standardized reporting frameworks to monitor progress and adjust strategies based on verified emissions data.

Embedding ESG in Investment Decisions

- Incorporate ESG Metrics

Integrate environmental performance indicators into your investment due diligence to assess sustainability risks and opportunities.

- Use Carbon Assessments

Leverage carbon footprint data to inform investment choices, balancing financial returns with environmental impact.

- Evaluate Climate Risks

Consider climate-related risks alongside financial factors when evaluating potential investments to protect long-term portfolio value.

Emphasizing Direct Emissions Reductions Over Offsets

- Prioritize Decarbonization

Focus on reducing emissions at the source within portfolio companies rather than relying heavily on carbon offsets.

- Invest in Low-Carbon Solutions

Allocate capital to businesses and projects that actively reduce greenhouse gas emissions through innovative technologies.

- Address Root Causes

Develop long-term strategies that tackle the fundamental sources of emissions to ensure lasting climate impact.

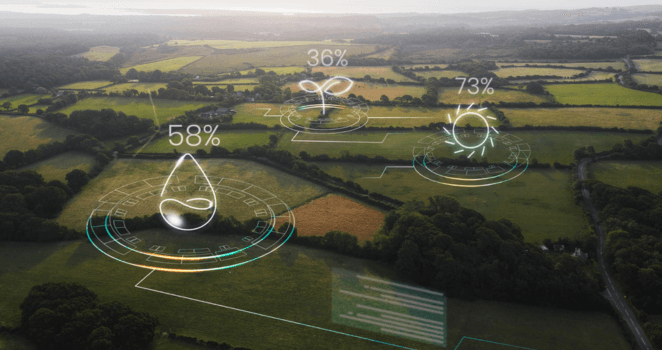

The Full Scope of Your Investment Emissions

Gain full visibility into your portfolio’s climate impact by uncovering hidden investment emissions, essential for transparency, regulatory alignment, and driving credible, profitable sustainability action.

Emissions Defined

Investment emissions represent the greenhouse gases linked to your financial investments, revealing the true environmental impact of the companies in your portfolio.

Emissions Defined

Investment emissions represent the greenhouse gases linked to your financial investments, revealing the true environmental impact of the companies in your portfolio.

Scope Differentiation

While Scope 1 and Scope 2 focus on direct operations and energy use, investment emissions are classified as Scope 3 Category 15, highlighting their unique significance.

Scope Differentiation

While Scope 1 and Scope 2 focus on direct operations and energy use, investment emissions are classified as Scope 3 Category 15, highlighting their unique significance.

Carbon Visibility

Investment emissions expose the often-overlooked indirect climate impacts, helping you see the full picture of your organization’s carbon footprint.

Carbon Visibility

Investment emissions expose the often-overlooked indirect climate impacts, helping you see the full picture of your organization’s carbon footprint.

Portfolio Impact

Operations of your investee companies can produce substantial emissions, making portfolio emissions a critical factor in your overall sustainability performance.

Portfolio Impact

Operations of your investee companies can produce substantial emissions, making portfolio emissions a critical factor in your overall sustainability performance.

Complete Accounting

Incorporating investment emissions into your carbon accounting ensures a complete, transparent view, empowering better decision-making and stronger ESG compliance.

Complete Accounting

Incorporating investment emissions into your carbon accounting ensures a complete, transparent view, empowering better decision-making and stronger ESG compliance.

Climate Accountability

Integrating investment emissions into your ESG strategy not only meets regulatory demands but also builds lasting stakeholder trust and competitive advantage.

Climate Accountability

Integrating investment emissions into your ESG strategy not only meets regulatory demands but also builds lasting stakeholder trust and competitive advantage.

High-Impact Sectors for Investor Emissions Reporting

Emissions Accountability in Financial Services

Banks, asset managers, and investment firms must account for emissions linked to their financed activities, often far exceeding operational emissions, to meet climate goals and support decarbonization across their investment portfolios.

High-Impact Emissions in Energy & Utilities

Investments in energy and utilities often lead to high levels of indirect emissions due to fossil fuel reliance, making comprehensive emissions accounting essential for aligning with Net Zero and ESG commitments.

Give it a try, it's free!

Free for 60 days, no credit card required

Simplify Investment Emissions Accounting With

Precision-Driven Reporting

Accurate investment emissions reporting starts with the right calculation method. Use the investment-specific method for precision with actual data, or apply the average-data method when direct data is unavailable. Spectreco helps you select the most effective approach to ensure compliance, consistency, and credibility in Scope 3 emissions disclosure.

Turn Insight into Impact

Closing the Loop on Investor Emissions Reporting

Spectreco’s ESG reporting solution empowers investors to unlock the full picture of their portfolio’s climate impact. With over 100 years of collective ESG experience and $250M in impact valuation, we help financial institutions accurately measure, disclose, and reduce Scope 3 Category 15 emissions. This transparency drives regulatory compliance, strengthens stakeholder trust, and fuels profitable, sustainable growth.

Accurate emissions accounting is critical to managing climate risks and achieving Net Zero goals across your investments.

Partner with Spectreco to transform emissions data into strategic, climate-forward investment decisions.