Climate change is not just knocking on the door but bursting through the windows. Businesses and investors face tough questions. How will climate change ESG risks affect your bottom line? In this blog, we’ll walk through what these risks look like, why they matter, and how companies can respond with solid environmental risk assessment ESG frameworks.

What Are the Major Physical Risks?

Flood Risk And Investments

Floods are powerful and indiscriminate. Flooding can damage assets, derail operations, and increase insurance losses. The United States Environmental Protection Agency (EPA) categorizes flooding under “acute” and “chronic” climate risks in the physical risk realm. For investors, that means capital tied up in flood-prone zones is inherently riskier.

Sea Level Rise Impact On Business

Coastal assets face creeping threats. As seas rise, ports, industrial zones, real-estate developments, and infrastructure become vulnerable. According to an analysis by S&P Global, by the 2090s, coastal flooding costs for large firms could increase almost 14 times compared with mid-century levels, if no adaptation occurs. For any business operating on or near a coast, ignoring sea level rise isn’t an option.

Extreme Weather Financial Risks

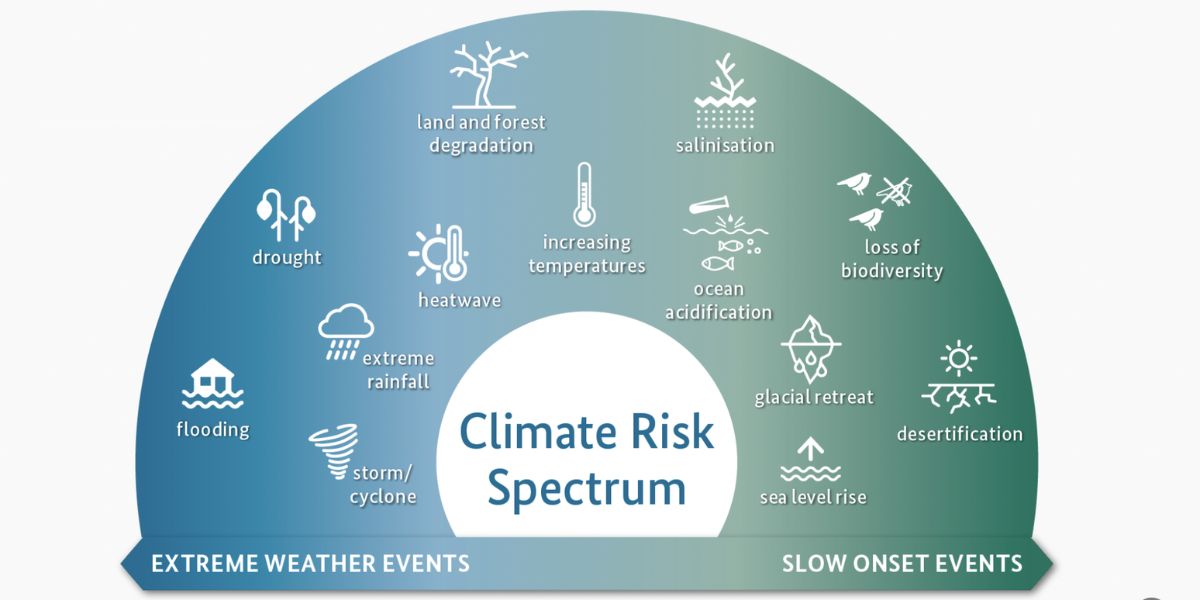

Storms, wildfires, droughts, and heat waves; these are no longer rare anomalies. Firms are facing increasing extreme weather financial risks that hit supply chains, operations, insurance costs, and regulatory scrutiny. A Reuters article notes that extreme weather events are just the tip of the iceberg. In sum, these physical hazards are real, measurable, and growing.

Why Are These Risks ESG Risks?

Environmental (E) Dimension

The “E” in ESG is influenced heavily by physical risks. Companies exposed to floods, sea level rise, or extreme weather may suffer asset losses, higher energy and repair costs, emissions spikes, and more. Consider this: firms facing high climate risk exposure tend to report shrinking environmental performance unless they act. A study in Sustainability found that firms with higher climate risk exposure should improve their environmental practices, recognizing the threat.

Social (S) Dimension

Climate-driven hazards frequently affect communities, workers, and vulnerable populations. A flood-affected supply chain doesn’t just disrupt manufacturing; it impacts livelihoods, health, and social equity. For local governments and municipal bond markets, the ripple effects can be severe. The Carnegie Endowment for International Peace highlights how the burden of responding to extreme weather falls mostly on local governments.

Governance (G) Dimension

Governance involves risk oversight, transparent disclosure, and strategic planning. Investors increasingly demand that companies perform environmental risk assessment ESG and report on how they manage climate exposures. A failure in governance can lead to mis-priced assets, regulatory fines, or loss of investor trust. S&P Global data projects that large firms may face up to $1.2 trillion annual physical risks by the 2050s under modest emission scenarios. In short, flood risk, sea level rise, and extreme weather are not just operational headaches; they are material ESG exposures.

How Does Each Risk Manifest and Impact Business?

Flood Risk and Its Business Impacts

Flooding can disrupt operations unexpectedly. Factories shut down, infrastructure fails, logistics collapse. Supply chain ripple effects happen because a single supplier hit by flooding can halt a multi-national production line. The risk isn’t abstract. Reuters reports that companies’ reliance on others makes them vulnerable to supplier disruptions caused by floods and storms.

Investments in flood-prone zones also face longer-term risk: property value declines, higher insurance premiums, and regulatory pressure for mitigation. Municipalities that ignore flood risk may also see weaker credit ratings. A report on the municipal bond market found climate change disasters to be increasingly relevant when it comes to market risk.

Sea Level Rise and Business Risk

Sea level rise is slower-paced than a storm but equally insidious. It creates chronic exposure: saltwater intrusion, higher baseline flood levels, and land loss. For coastal infrastructure, this means design lifetimes must be revisited, and new investment cases require higher costs. The S&P Global analysis points out that coastal flooding costs for major companies could jump dramatically by the end of the century.

For business, this commits firms to enhanced adaptation costs, higher maintenance expenses, and possible stranded assets. If you own property near sea level or supply from coastal facilities, the time horizon of your investment must factor in this risk.

Extreme Weather and Financial Shock

When a hurricane, wildfire, or heat wave hits, the effects are immediate. Infrastructure damage, power outages, workforce disruption, insurance losses, downtime, and reputational damage. From a financial standpoint, extreme weather means unexpected costs, disrupted revenue flows, and increased volatility. Companies must factor in resilience now if they are to avoid downside surprises.

How to Build a Responsive Strategy?

Conduct A Robust Risk Assessment

Start with mapping hazards: flood zones, sea level rise exposure, and weather extremes. Use data and scenarios, and stress test assets. Lean into tools like risk management software or partner with expert analysts from Spectreco who can overlay hazard data on asset portfolios. This gives a clearer picture of climate risk exposures.

Embed Climate Change ESG Risks in Corporate Strategy

Make climate risk a board-level concern. Link the risks to balance sheet exposures, credit lines, supply chain dependencies, and asset valuation. Experience shows that without executive buy-in, climate risks stay buried in operational silos.

Adapt Operations and Investment Decisions

If flooding is a risk, invest in drainage, raised floor levels, and flood-proofing. If sea level rise looms, factor in higher design thresholds, protective infrastructure, or relocation logic. For extreme weather, build operational resilience: backup power, diversified supply chains, and insurance review. All of this ties into environmental risk assessment, ESG, and sustainable business continuity.

Disclose Transparently

Investors expect transparency on how you manage climate risks and what exposures you face. ESG frameworks increasingly look at physical risk, not just emissions. Transparent disclosures build trust and can reduce the cost of capital.

Monitor, Review, and Iterate

Climate risks evolve. What is a 100-year flood today may become a 20-year flood in a decade. Sea level rise accelerates. Companies need to monitor, adjust models, and revise strategies. This is not a “set-and-forget” exercise.

Case Considerations: Who’s Exposed and What It Means

- Coastal real-estate owners: Highly exposed to sea level rise impact on business, especially if leases don’t reflect risk.

- Supply-chain heavy manufacturers: Flooding or extreme weather at supplier sites can halt global production.

- Utilities and infrastructure: S&P Global estimates utilities face some of the highest costs tied to physical risk.

- Municipal bonds and local governments: Infrastructure failure, flood damage, and sea level rise all undermine credit if not managed.

- High-risk asset investors: Assets in hazard zones face cost surprises, insurance increases, and potential stranded value.

These illustrate how the risks cut across sectors and geographies. The key is adopting a business-wide lens for climate change ESG risks.

The Value of Early Action Vs the Cost of Delay

Studies suggest the cost of acting now is far lower than the cost of responding later. Ignoring flood risk, sea level rise, or extreme weather leads to larger losses, higher insurance premiums, increased scrutiny, and loss of investor confidence. In a tightly integrated global economy, the sooner these physical risks are addressed, the more resilient operations and finances will be.

Conclusion

Flood risk, sea level rise, and extreme weather are now urgent ESG risks with tangible business impacts. Companies that don’t treat them as part of their environmental risk assessment ESG framework may find themselves exposed to unexpected costs, stranded assets, and reputational damage. At the same time, it is possible to turn risk into resilience. With robust assessment, strategic planning, transparent disclosure, and operational adjustment, firms can navigate these challenges proactively. The question is not “if” climate risk will affect you, but “when” and “how prepared” you will be. Spectreco stands ready to help firms enact ESG consulting services and data-driven solutions so you stay ahead of the curve and build lasting business resilience in a changing climate.