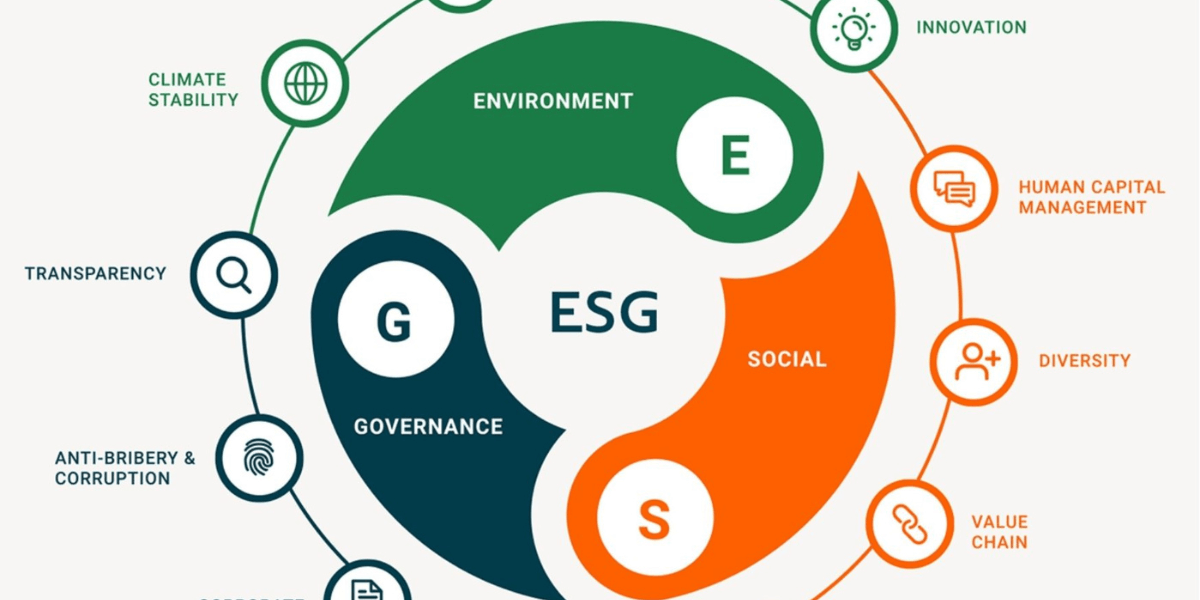

Sustainability has become more than a buzzword; these days and companies are under increasing pressure from investors, regulators, and consumers to prove their commitment to environmental, social, and governance (ESG) practices. While intentions matter, performance is ultimately measured through data.

That’s where ESG metrics come in. These indicators allow organizations to monitor progress, improve transparency, and demonstrate accountability. Tracking the right ESG metrics is key to building a sustainability strategy that delivers results and drives long-term value.

Why ESG Metrics Matter

ESG metrics give organizations measurable insights into their sustainability performance. Without them, commitments to reduce carbon emissions or improve social equity remain vague and unverifiable. By adopting ESG reporting standards, companies ensure their progress is aligned with global frameworks such as GRI, SASB, and TCFD. These standards allow for comparability across industries and reassure stakeholders that the data is credible.

Tracking metrics also helps organizations identify gaps, set realistic targets, and monitor improvements. Ultimately, ESG metrics transform sustainability from a promise into a performance-driven strategy.

Environmental Metrics: Measuring Climate and Resource Impact

The environmental dimension of ESG metrics focuses on how business operations affect the planet. Key sustainability performance indicators include:

1. Carbon Emissions

Tracking the scope of greenhouse gas emissions is fundamental. This allows companies to measure direct emissions, purchased energy impacts, and supply chain-related emissions.

2. Energy Efficiency

Measuring energy consumption per unit of output or per square foot of facilities provides insights into efficiency improvements. Companies are increasingly setting ESG targets for companies tied to renewable energy adoption and energy intensity reduction.

3. Water Use and Waste Management

Metrics on water withdrawal, recycling rates, and hazardous waste reduction help assess how responsibly resources are being managed. These are especially critical in industries with high environmental footprints.

4. Biodiversity and Land Use

Though harder to quantify, tracking impacts on ecosystems, land restoration projects, and conservation initiatives can demonstrate a company’s commitment to protecting natural habitats.

Social Metrics: Tracking Human-Centered Progress

Social metrics evaluate how businesses impact people, employees, communities, and consumers. These are becoming just as important to investors as environmental measures.

5. Diversity, Equity, and Inclusion (DEI)

Metrics on workforce composition by gender, ethnicity, and other demographics provide transparency on diversity efforts. Companies are increasingly tying executive performance to DEI targets.

6. Employee Well-Being

Indicators and workplace safety records reflect how well companies are supporting their workforce.

7. Community Impact

Social sustainability can be measured through community investment, volunteer hours, and partnerships with local organizations. These demonstrate the broader societal contributions of a company.

8. Human Rights and Supply Chain Practices

Tracking supplier audits, fair labor certifications, and grievance mechanisms ensures businesses uphold ethical practices across the value chain.

Governance Metrics: Strengthening Trust and Accountability

Governance is often overlooked but plays a vital role in sustainability strategies. It ensures that ESG commitments are not just marketing slogans but are backed by robust systems.

9. Board Diversity and Independence

Metrics on the composition of boards, including representation of women and minorities, signal inclusivity at the highest decision-making levels.

10. Executive Compensation Alignment

Tying bonuses and incentives to ESG outcomes shows accountability. Companies are increasingly linking pay structures to achieving corporate sustainability metrics.

11. Transparency and Reporting

Clear disclosure of ESG data, adherence to reporting frameworks, and anti-corruption measures are governance metrics that build investor confidence.

Choosing the Right ESG Metrics

Not all ESG metrics are equally relevant for every company. For instance, a manufacturing firm may prioritize emissions and waste management, while a financial services firm may focus more on governance and ethical business practices. The most effective strategies align ESG metrics with business goals and stakeholder expectations.

When choosing which metrics to track, companies should consider:

- Materiality: Which ESG issues have the greatest impact on the business and its stakeholders?

- Regulation: What disclosures are required under local or international laws?

- Benchmarking: Which metrics are standard in the industry and expected by investors?

Using ESG Metrics to Drive Performance

Collecting ESG metrics is only the first step. The real value comes in using the data to set goals, guide decision-making, and continuously improve. For example, companies can establish ESG targets for companies such as reducing emissions by a certain percentage within a defined timeframe. Regular progress reports not only hold the organization accountable but also strengthen stakeholder trust.

Technology plays a big role here. Advanced data platforms make it easier to gather, validate, and analyze ESG data, reducing the risk of greenwashing. Artificial Intelligence and digital tools are increasingly being used to track real-time ESG performance and provide insights for better decision-making.

The Role of Advisory and Consultancy Support

Building an effective ESG strategy often requires expert guidance. Sustainability advisory services can help organizations determine which metrics are most relevant, establish processes for accurate data collection, and align reporting with global standards.

Similarly, consultancy services provide the expertise needed to design action plans, integrate ESG into business strategy, and ensure accountability at every level of the organization. These services are invaluable for businesses seeking to understand the complex landscape of sustainability reporting and performance measurement.

Frequently Asked Questions

1. What are ESG metrics?

ESG metrics are measurable indicators that assess a company’s environmental, social, and governance performance.

2. Why are sustainability performance indicators important?

They provide transparency, allow benchmarking, and help businesses track progress toward sustainability goals.

3. How do ESG reporting standards support companies?

Standards such as GRI, SASB, and TCFD ensure consistency and comparability in ESG disclosures, making them more credible to stakeholders.

4. Which corporate sustainability metrics should companies prioritize?

It depends on the industry, but common metrics include emissions, energy efficiency, diversity, governance, and supply chain practices.

5. How do ESG metrics influence investor decisions?

Investors rely on ESG data to assess risks, identify sustainable companies, and guide capital allocation.

6. What role does technology play in ESG reporting?

Digital tools and AI platforms help automate data collection, improve accuracy, and provide real-time ESG insights.

7. How can companies set ESG targets for companies?

By identifying material issues, aligning with global standards, and establishing clear, measurable goals with timelines.

8. How do consultancy services help with ESG metrics?

ESG consultancy services provide expertise in selecting, tracking, and reporting ESG metrics while ensuring compliance with regulations.

Conclusion: Turning Data into Impact

ESG metrics are the backbone of any performing sustainability strategy. They move sustainability out of the realm of rhetoric and into measurable, actionable progress. By tracking the right indicators across environmental, social, and governance dimensions, companies can meet stakeholder expectations, comply with regulations, and create long-term value.

Spectreco partners with businesses worldwide to design and implement ESG strategies that prioritize the right metrics and drive real impact. We offer global expertise to ensure companies track, report, and achieve their sustainability goals effectively. So get in touch today!

32 comments on "11 ESG metrics to track for a performing Sustainability strategy"

donald trump cc

-Having read this I thought it was rather enlightening.

I appreciate you taking the time and effort to put this

short article together. I once again find myself spending a lot of

time both reading and leaving comments. But so what, it was still worthwhile!

Look into my webpage … donald trump cc

pros and cons of online pharmacies

-Howdy this is kind of of off topic but I was wondering if blogs

use WYSIWYG editors or if you have to manually code with

HTML. I’m starting a blog soon but have no coding expertise so I wanted to get guidance from someone with experience.

Any help would be greatly appreciated! https://truepharm.org/

pros and cons of online pharmacies

-Howdy this is kind of of off topic but I was wondering if blogs

use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise so I wanted to

get guidance from someone with experience. Any help would be

greatly appreciated! https://truepharm.org/

blackbet

-It’s a pity you don’t have a donate button! I’d most certainly donate to this brilliant blog!

I guess for now i’ll settle for bookmarking and adding your

RSS feed to my Google account. I look forward to

brand new updates and will talk about this website with my Facebook group.

Chat soon!

Have a look at my web site :: blackbet

luxchecker pm

-This post will help the internet viewers for building up new webpage

or even a weblog from start to end.

Also visit my web blog luxchecker pm

4check

-Pretty section of content. I just stumbled upon your blog and in accession capital

to assert that I acquire actually enjoyed account your blog posts.

Anyway I’ll be subscribing to your augment and even I

achievement you access consistently fast.

Review my website … 4check

xleet shop

-Marvelous, what a web site it is! This webpage provides useful information to us, keep it up.

Also visit my page – xleet shop

luxchecker pm

-Can I simply say what a relief to discover somebody who genuinely

understands what they are talking about on the web.

You actually realize how to bring a problem to light and make it important.

More and more people need to check this out and understand this

side of the story. I was surprised you’re not more popular given that you surely possess the gift.

Also visit my web blog luxchecker pm

ssn24

-No matter if some one searches for his required thing, thus he/she needs to be available

that in detail, thus that thing is maintained over here.

Feel free to visit my homepage :: ssn24

blackpass

-Hi there! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted

keywords but I’m not seeing very good results.

If you know of any please share. Appreciate it!

Feel free to surf to my site: blackpass

tox23

-I am in fact thankful to the owner of this web page who has shared this fantastic article at here.

Feel free to visit my blog :: tox23

wizardshop.cc review

-Heya! I understand this is kind of off-topic but I

needed to ask. Does building a well-established website such as yours take a massive amount work?

I’m completely new to operating a blog however I do write

in my diary every day. I’d like to start a blog so I can share my own experience and

thoughts online. Please let me know if you have any kind of recommendations or tips for new aspiring blog

owners. Thankyou!

Here is my website … wizardshop.cc review

xleet

-Hi there, just wanted to say, I enjoyed this blog post.

It was practical. Keep on posting!

Also visit my web blog … xleet

ultimateshop to

-Hi there everyone, it’s my first pay a quick visit at this web site, and piece

of writing is really fruitful in favor of me, keep up posting these types of content.

Check out my webpage; ultimateshop to

proone.cc

-I am actually grateful to the owner of this web site who has shared this wonderful paragraph at at this place.

Have a look at my website … proone.cc

basetools login

-I’m not sure why but this blog is loading extremely

slow for me. Is anyone else having this issue or is it a problem

on my end? I’ll check back later on and see if

the problem still exists.

Stop by my web site basetools login

castrocvv login

-I am sure this piece of writing has touched all the internet viewers,

its really really pleasant paragraph on building up new

web site.

Feel free to surf to my homepage castrocvv login

jerrys login

-Hi to every one, the contents existing at this site are in fact

awesome for people experience, well, keep up the good work fellows.

My blog … jerrys login

bankom cc

-I am truly pleased to glance at this blog posts which includes lots of valuable data, thanks for providing such information.

Here is my web page … bankom cc

ultimateshop to

-I visited multiple sites but the audio quality

for audio songs existing at this web page is genuinely superb.

Here is my blog ultimateshop to

findsome

-My partner and I absolutely love your blog and find a lot of

your post’s to be precisely what I’m looking for.

Do you offer guest writers to write content for you personally?

I wouldn’t mind creating a post or elaborating on most of the subjects

you write regarding here. Again, awesome web

log!

Look at my web blog – findsome

findsome cc

-Hi everybody, here every one is sharing these familiarity,

therefore it’s good to read this blog, and

I used to pay a visit this website everyday.

my webpage :: findsome cc

russianmarket

-Hi i am kavin, its my first time to commenting anyplace, when i read this

piece of writing i thought i could also create comment due

to this brilliant paragraph.

My page russianmarket

castrocvv login

-My spouse and I stumbled over here different website and thought I might as well check things out.

I like what I see so i am just following you.

Look forward to checking out your web page for a second time.

my site; castrocvv login

infodig

-I blog frequently and I really appreciate your content.

Your article has truly peaked my interest.

I will take a note of your website and keep checking for new information about

once a week. I opted in for your RSS feed too.

Visit my web site infodig

savastan0

-I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble.

You’re wonderful! Thanks!

Here is my blog :: savastan0

just kill cc

-What’s up to all, it’s truly a fastidious for me to pay a

visit this website, it contains valuable Information.

my blog post – just kill cc

bclub

-First of all I want to say superb blog! I had a quick question that I’d

like to ask if you don’t mind. I was interested to find out

how you center yourself and clear your head prior to writing.

I’ve had a difficult time clearing my mind in getting my thoughts out.

I truly do enjoy writing but it just seems like the first 10

to 15 minutes are usually wasted simply just trying

to figure out how to begin. Any ideas or hints? Thank you!

Feel free to visit my webpage bclub

ultimateshop

-Thanks a bunch for sharing this with all of us you actually

recognize what you’re speaking approximately! Bookmarked. Please

also discuss with my site =). We may have a hyperlink change arrangement between us

Stop by my blog post :: ultimateshop

apaldocasino

-Alright, Apaldocasino caught my eye. The layout is easy to navigate and they seem to have some competitive bonuses. I gave it shot the other night and I actually won something! apaldocasino

solaireonline

-Looking for a solid online casino in the Philippines? Solaire Online is worth a look. Easy to navigate and they’ve got all the popular games. Give it a shot! solaireonline

c9tayaslotlogin

-If you’re after slots, C9TayaSlotLogin is alright. Gets you straight into the fun, with nothing fancy. Have an easy login at c9tayaslotlogin