Designed to align with global disclosure standards and investor expectations, providing your organization’s ESG performance with the credibility and rigor demanded by capital markets.

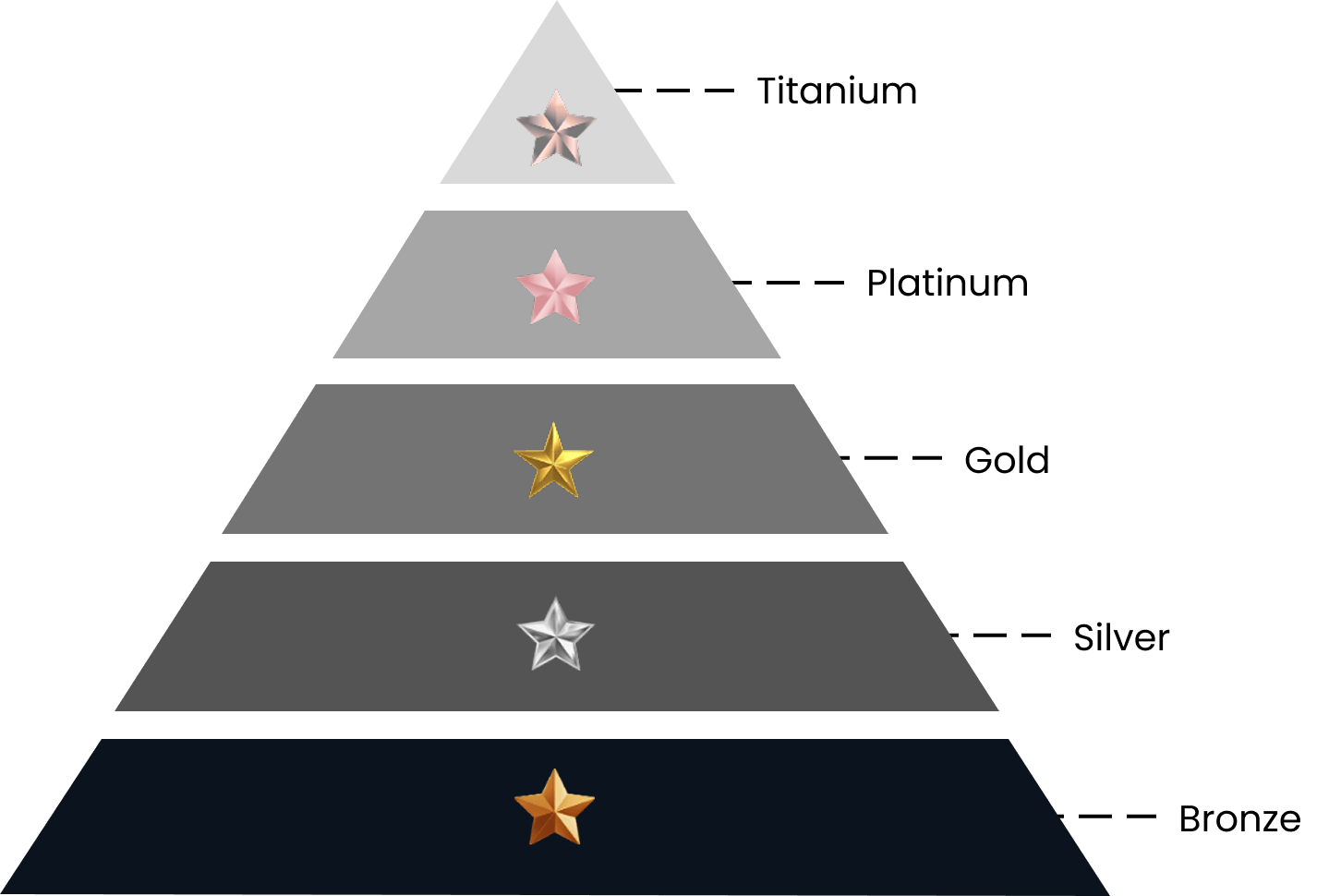

The ESG Maturity Rating is a five-level ESG maturity assessment system embedded within the Spectreco platform. It enables organizations to systematically track, validate, and communicate their sustainability progress with confidence and transparency.

This framework supports a data-driven progression with professionals in the loop from initial ESG commitment to verified performance, effectively signaling measurable ESG advancements and financial performance to investors, regulators, and key stakeholders.

Each badge represents a verified indicator of ESG maturity, reflecting robust governance practices, transparency, and tangible sustainability progress.

The framework is aligned with evolving ESG disclosure mandates across key jurisdictions, supporting compliance with a broad spectrum of requirements.

Earned badges can be integrated into investor presentations, sustainability reports, and digital platforms, boosting the organization’s profile in the market.

Provides ESG teams with a standardized language and benchmarking tool to align sustainability initiatives with corporate strategy and investor expectations.

The ESG Maturity Rating delineates ESG development across five progressive stages, enabling clear communication of your organization’s sustainability journey and readiness for investor, stakeholders, partners, and regulators’ scrutiny.

Enter baseline data, define company size, specify industry, and establish your starting point for ESG transition through our consulting service for investors, businesses, and governments.

Our recommendation engine gives tailored interventions, based on industry, region, company size, and more.

Monitor and report your progress towards ESG goals, assign tasks across teams, and ensure compliance.

Mapped to ESG commitment, implementation, and independent validation

Overview

At this highest stage, the organization demonstrates mature ESG performance through externally assured reporting, a positive economic outlook, and very high confidence in achieving its targets. This level signals credibility, resilience, and leadership — positioning the organization as ESG-verified and investment-grade.

Detailed Criteria

Key Signals of Readiness

Overview

The organization has moved from internal execution to external reporting — publishing its first sustainability report in alignment with global or regional standards. With implementation underway and verified stability in operations, the organization demonstrates strong progress toward its ESG goals.

Detailed Criteria

Key Signals of Readiness

Overview

This stage marks the shift from planning to execution. The organization is now actively implementing its ESG strategy, supported by defined baselines, internal systems, allocated resources, and ongoing oversight. The economic outlook is stable, and the organization has high confidence in achieving its stated targets.

Detailed Criteria

Key Signals of Readiness

Overview

At this stage, the organization has translated its commitment into a structured ESG strategy. This includes identifying material issues, setting clear sustainability targets, and developing a high-level transition plan — all with governance oversight and public disclosure.

Detailed Criteria

Key Signals of Readiness

Overview

At this stage, the organization has formally recognized sustainability and climate action as a strategic priority. The ESG commitment has been endorsed at the highest level of governance and publicly communicated, laying the groundwork for structured integration and future action.

Detailed Criteria

Key Signals of Readiness

The ESG Maturity Ranking awarded through the Spectreco platform is based on automated, data-driven assessments of verified progress milestones recorded within the platform. Our proprietary Transition Scale framework tracks organizations’ ESG advancement across defined stages, with rankings issued upon achievement of specific, measurable criteria.

ESG intent is formally endorsed at the leadership level and shared transparently.

ESG intent is formally endorsed at the leadership level and shared transparently.

ESG intent is formally endorsed at the leadership level and shared transparently.

ESG intent is formally endorsed at the leadership level and shared transparently.

ESG intent is formally endorsed at the leadership level and shared transparently.

Earn your verified ESG Maturity Rating and demonstrate measurable ESG advancements through Spectreco’s automated platform.

Strengthen investor trust, align with regulations, and elevate your market leadership-all with real-time insights and expert validation.

Book a session with our team or email us at connect@spectreco.com

Sign up for our newsletter and stay ahead of the curve. With every edition, you’ll receive the latest news, updates, and insights from our experts, straight to your inbox.

By subscribing, you agree with our privacy policy and our terms of service.